What is a Specialized Investment Fund?

A Specialized Investment Fund (SIF) is a regulated, flexible, and supervised collective investment scheme primarily designed for:

- High-net-worth individuals (HNIs)

- Institutional investors

- Professional investors

It allows for a broad investment strategy—ranging from traditional assets like equities and bonds to alternative assets such as:

- Real estate

- Private equity

- Infrastructure

- Hedge funds

Note: Derivatives can also be used for hedging, speculation, and arbitrage, with a maximum allocation of 25%.

Minimum Investment Required: ₹10 Lakhs

What Sets SIFs Apart?

- Flexible Investment Strategy

- Regulated by SEBI

- Risk Diversification

- Tax Efficiency

- Hedging, speculation, and arbitrage allowed (up to 25%)

Who Invests in SIF?

SIFs attract a diverse group of sophisticated investors, including:

- Institutional investors

- Family offices

- High-net-worth individuals

Foreign Portfolio Investors (FPIs) looking to diversify holdings in global or sector-specific markets

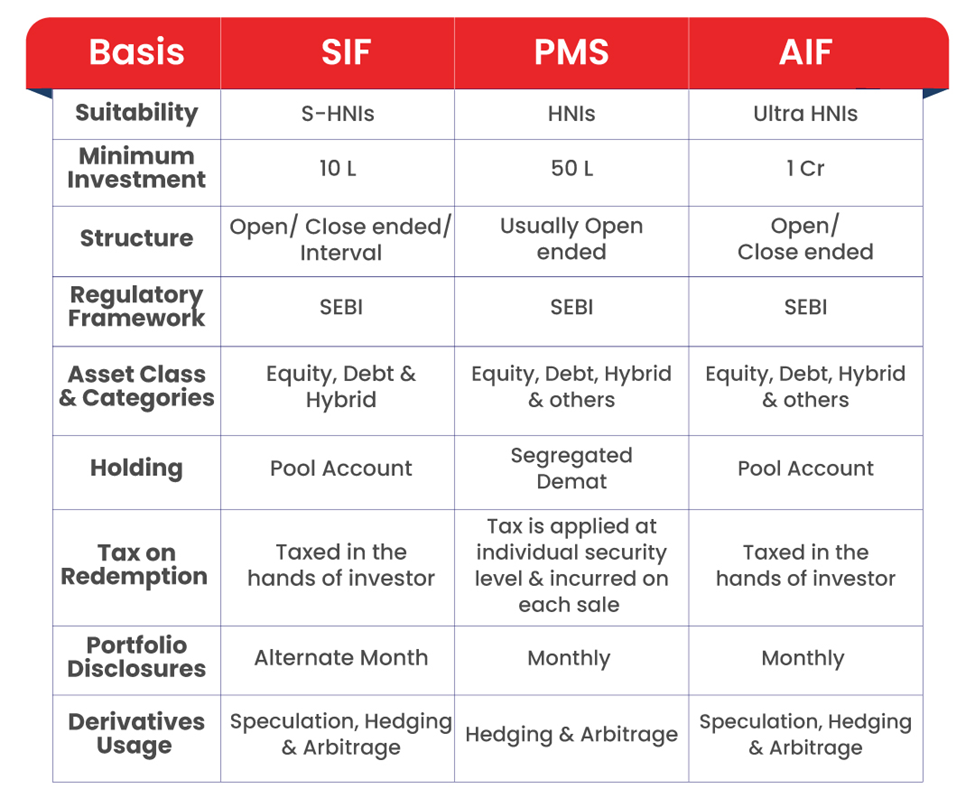

Understanding SIFs in Context: How They Compare with PMS and AIF Structures

Each investment vehicle serves a different type of investor. Here’s how SIF, PMS, and AIF compare:

This comparison shows that while Portfolio Management Services (PMS) and Alternative Investment Funds (AIFs) have their own merits, SIFs offer a unique blend of regulatory oversight, flexibility, and diversification with a relatively low entry point of ₹10 Lakhs—making it a compelling option for smart investors.

Conclusion

A Specialized Investment Fund is not just another investment vehicle—it’s a strategic, flexible solution for seasoned investors aiming to expand their portfolios beyond conventional boundaries. Its structure supports innovation, adaptability, and diversification—qualities that are crucial in a fast-evolving global market.

Whether you’re looking to complement your systematic investment plan or explore new frontiers in asset diversification, SIF investment opens doors to smart, structured, and scalable wealth creation.